Financing the Journey from Startup to SME – Busting the Jargon

The varied funding structures used by new companies can be a bewildering topic for the uninitiated, not least due to the fact that it is mired in financial jargon. How many of the British public could explain how seed funding differ from mezzanine finance for example? Or who supplies these different types of funding? Not too many, I would wager. But we live in a country where small businesses are integral to our economic prosperity, so understanding how these companies gain the funding that underpins their development is a useful accolade. Let’s cut through the jargon and take a look at the key concepts.

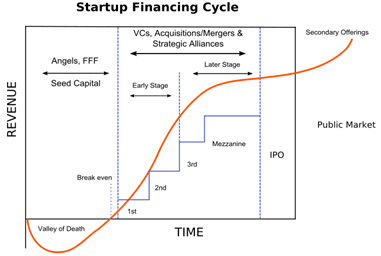

Source: http://edtechfrontier.com/tag/financing-cycle-of-investment/

When any company is being created, or in the early stages of operation, it is often described as a startup. Companies at this stage of their life cycle are often not profitable or even generating revenue. They thus desperately require a financial lifeline to help them navigate through this formative period. This seed capital, as it is known, is usually equity rather than debt and allows startups to invest in areas such as product development and general operations to get them on their feet. So where do they look to obtain it? It is hard to come by from traditional funders such as banks, or venture capitalists as it considered a very high risk investment, so startup directors must often look to friends, family and their own savings for this initial cash injection. It is also likely that some angel investors will be interested in investing at this very early stage. These investors are often wealthy veteran entrepreneurs who invest their own money and can also offer advice based upon their own experiences. Latterly, of course, crowdfunding platforms have also offered funding solutions to these ventures.

If this seed capital is deployed successfully and the startup moves forward, the business may then be in a position to launch a new round of funding and attract new investment when the initial funding runs out. This next round will likely be referred to as a Series A funding round and may be followed by a Series B, C, D and so on. Unsurprisingly, these post-seed funding rounds are sometimes termed alphabet rounds. Much like the initial seed investment these rounds will usually be for a stake in the equity of the business, though some businesses may offer debt instead if their balance sheets are robust enough and directors don’t want to dilute their ownership. Unlike the initial round, however, the business will now likely be able to attract institutional investment from venture capitalists to stabilise them over the medium-term. Venture capitalists invest through a business, rather than as individuals or part of a syndicate as angel investors do, and also tend to offer larger amounts than angels. They will likewise offer a growing business support and contacts to help them, but will generally take a more active role in the running of the business and require a seat on the board too.

Where small businesses choose to turn for their funding from this point onwards depends on their unique predicaments. Numerous options are available, and these will be explored and explained in part two of this jargon-busting blog.